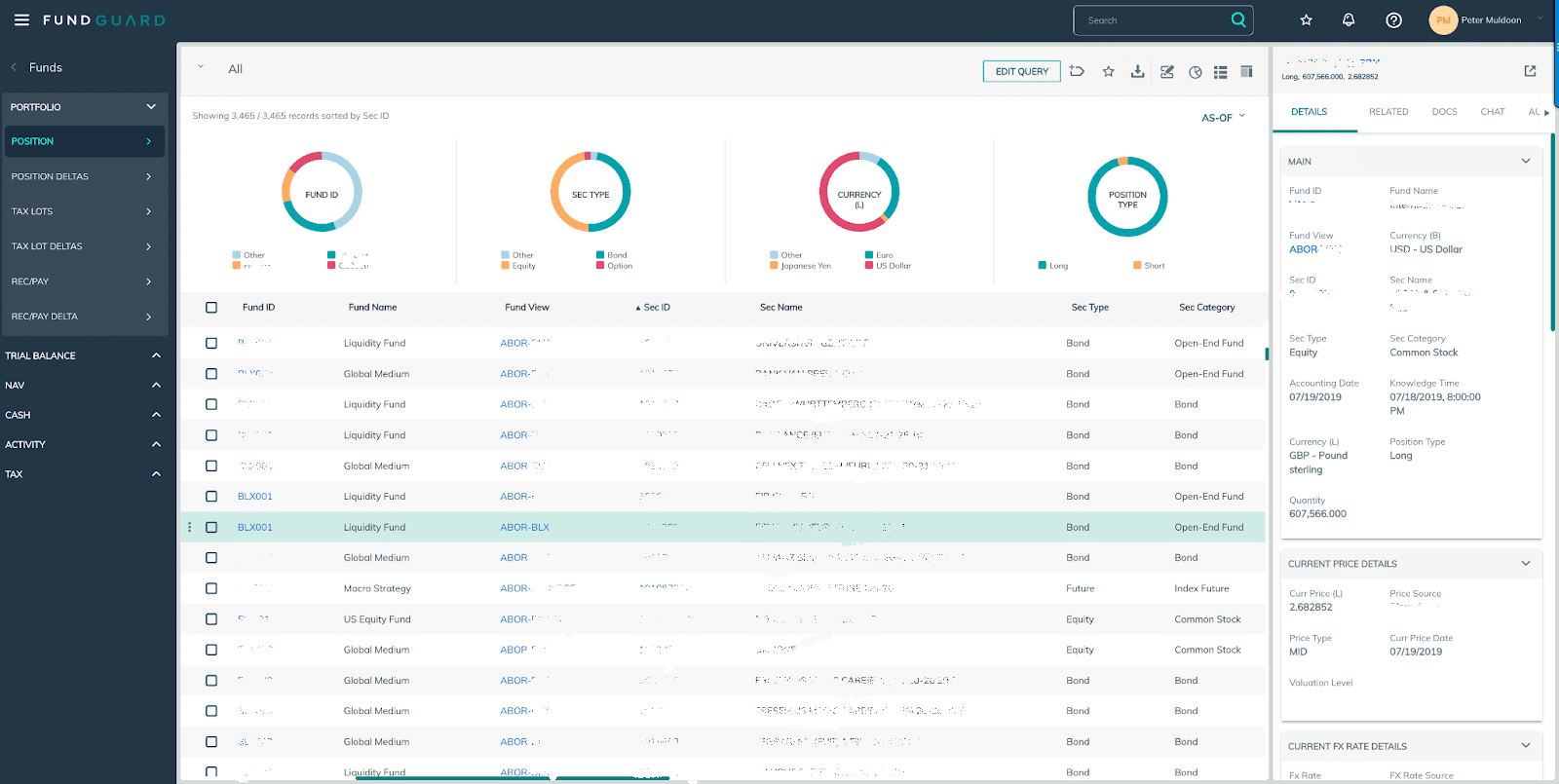

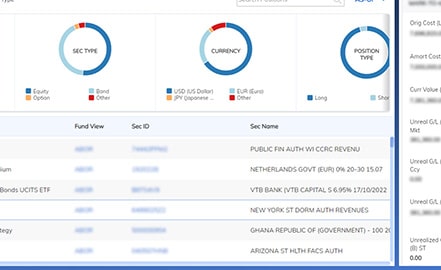

Real time and knowledge-date historical access

Position • Valuation • Ledger • Cash Flow

Multi book with single fund/trade

ABOR/IBOR • GAAP/Tax • currencies • and more

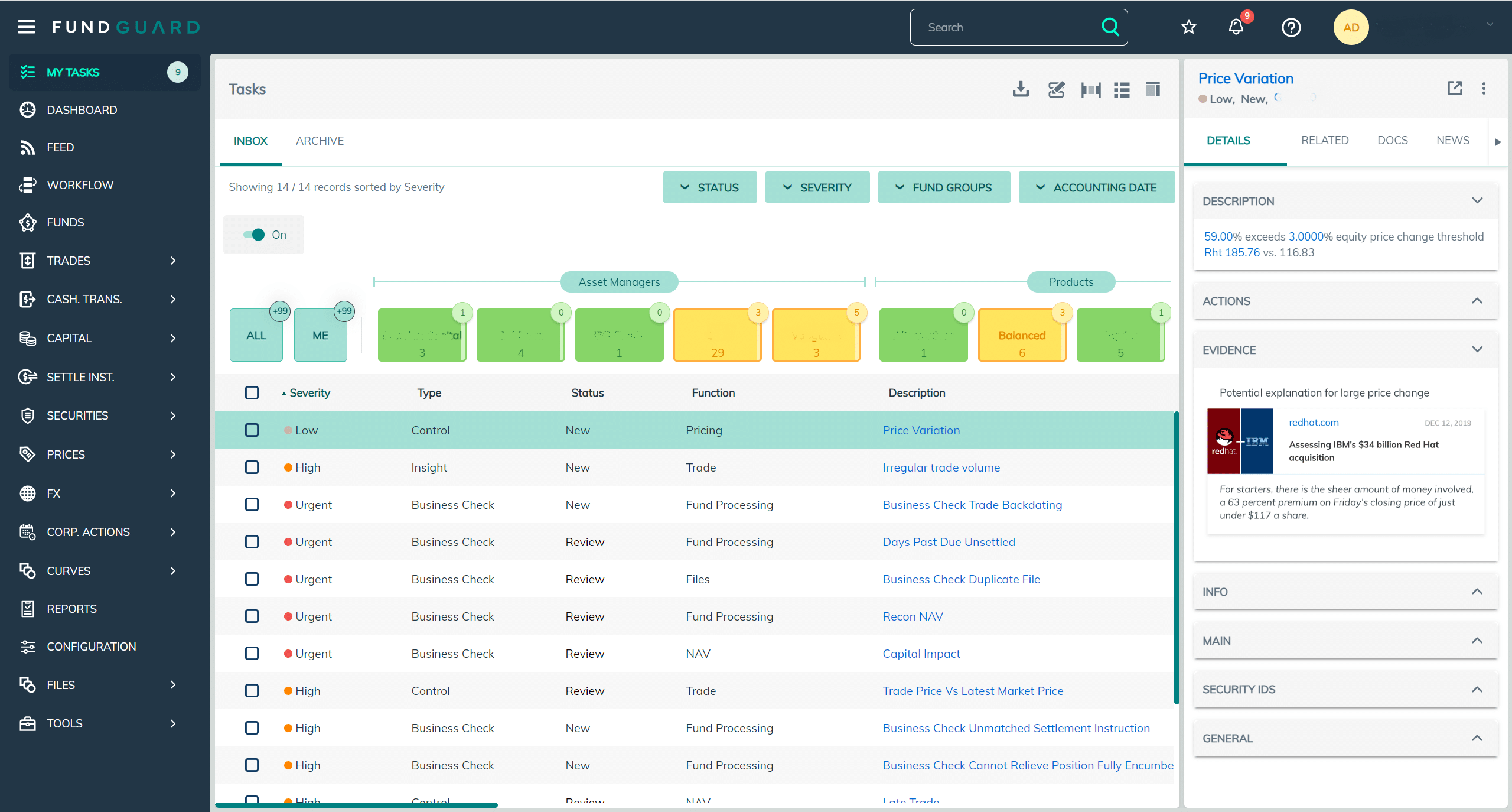

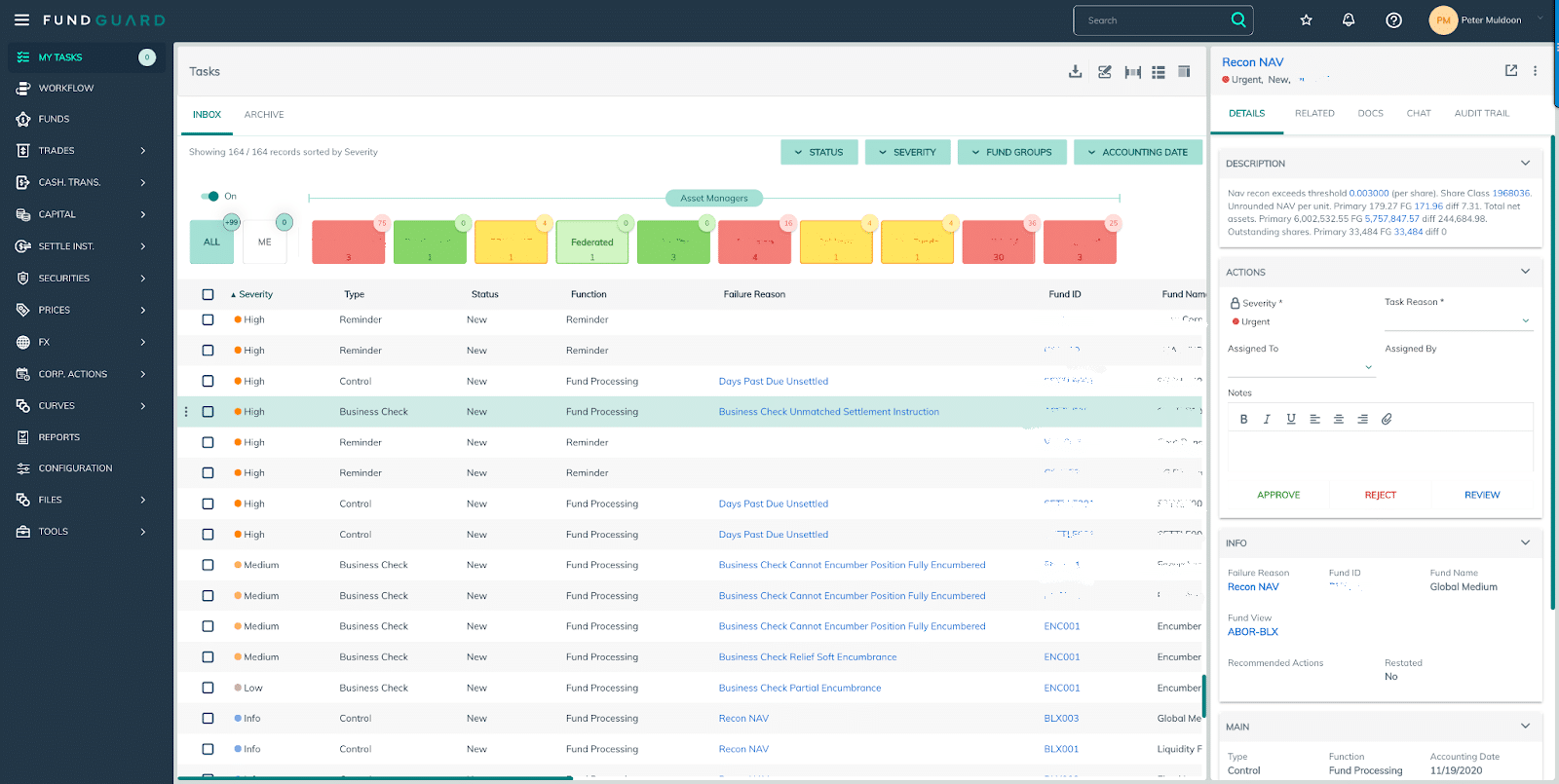

Anomaly detection and recommendations

Financial anomalies • Ops KPI’s • auto-resolve exceptions

Workflows and collaboration

Oversight • Escalation • Contextual Chat

Rapid onboarding

Fast File Mapper “ETL” • Run • Reconfigure • Rerun • Repeat

All-in-one platform any time, anywhere

Report Studio • Recon • Ops and Management Dashboards

STATE OF THE ART ENTERPRISE CLOUD TECHNOLOGY

Multi-books of record

Portfolio history with

full record‑keeping

Real-time processing

and controls framework

Continuous reconciliation

Cash and positions data by dimension, locations and status

Real-Time Investment Accounting Platform with Unlimited Multi-Book Capabilities – All from a Single Instance of All Trading Activities

Controls and digital workflows always running

Portfolio, GL and NAV balance values constantly versioned

Continuously executed test scenarios and recon

All Investment Funds via Single Platform to Service Front, Middle, Back-Office Applications

Increased data quality, low operations costs

Seamless front office integration with FundGuard’s Analytics Engine

Single source of truth and data across all systems

Fully Automated True-SaaS Accounting-Based Contingent NAV

Low-touch and fully matching Shadow NAV solution

Secondary location to address cyber risk

Full operation system ready if your primary system fails

Establish a consistent global accounting operating model, transform product offerings to be API-driven, cloud-based and real-time, and leverage financial and operational data to deliver meaningful insights and operational improvements.

10x step-up using real time multi dimension design, AI-powered anomaly detection and streamlined collaborative and intuitive workflows.

Eliminate need for hardware procurement, third party licenses, multi-vendor management, installation, testing, maintenance and upgrades.

Support new financial products, new regulations, single transaction multi book, real time financials, and new technologies.

Protect your funds’ proprietary and most critical data and valuation while scaling for the future with our unparalleled and fully automated NAV Contingency, Primary NAV (ABOR) and Middle Office (IBOR) solutions.

Our clients are shaping the future of investment accounting and will be the first to see the benefits of a high-quality utility that is informed by cross-industry collaboration, removes the pain and risk of back-office processes and frees up time and resources for true differentiators.

Multiple Fund Views

Complete with general ledgers and NAV values in addition to portfolio holdings and cash

Real-Time Processing and Controls Framework

Fully configurable setting for complete processing of events and activities in real-time

NoSQL Big-Data Database Framework

Designed to handle near limitless volumes of data without the common constraints of relational databases

Redundancy for High Availability

Cloud-native, big-data database and distributed architecture enables near real-time business continuity and disaster recovery

Sign up for FundGuard Insights

Your use of information on this site is subject to the terms of our Legal Notice.

Please read our Privacy Policy.